Chancellor confirms immediate stamp duty holiday – raising threshold to £500,000

9th July 2020

The Negotiator - Richard Reed

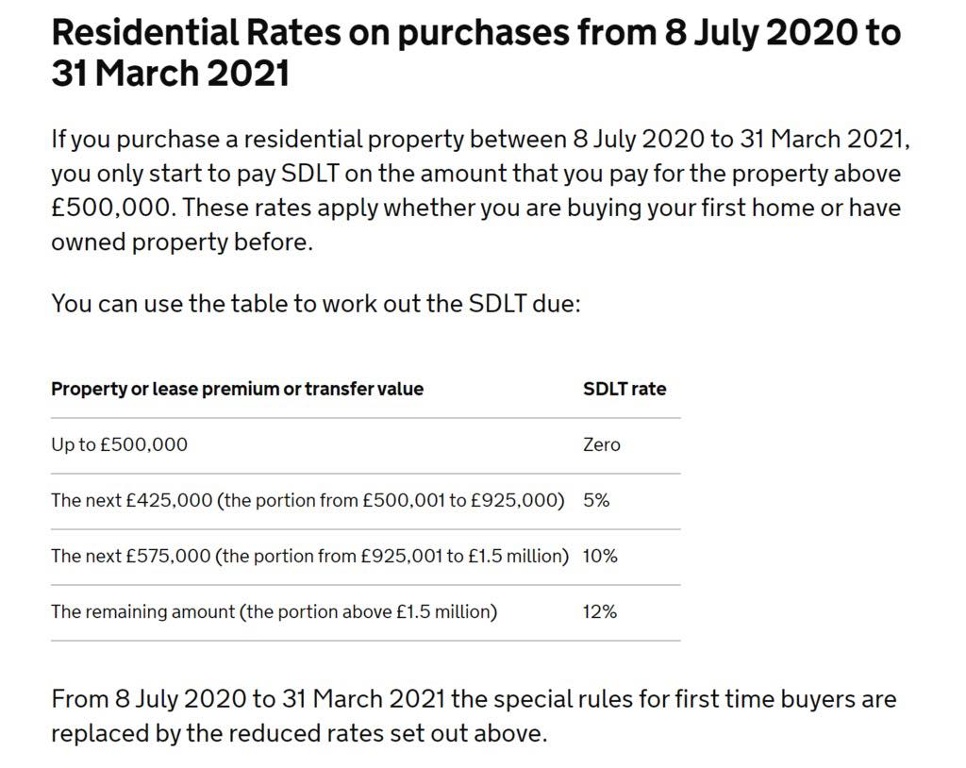

Chancellor Rishi Sunak has confirmed the much-rumoured stamp duty holiday, raising the threshold from £125,000 to £500,000 until 31 March next year.

Unveiling today’s mini-Budget, he said the changes would take effect immediately, cutting the average stamp duty bill by £4,500, with 9 out of 10 house buyers paying no stamp duty at all.

“If you stand by your workers we will stand by you,” Mr Sunak told the Commons. Rightmove reported that within first half-hour of the announcement, traffic to its website jumped by 22%.

HELP FOR LANDLORDS

The Treasury has confirmed that landlords will also benefit from the temporary stamp duty reforms, From today the 3 per cent stamp duty levy on the purchase of additional dwellings by landlords in England and Northern Ireland will change from covering the first £125,000 of a property to the first £500,000. Thereafter the rates will be 8 per cent on the next £425,000, 13 per cent on the next £575,000 and 15 per cent on the remainder. The measures will be in place until 31 March 2021.

Ben Beadle of the NRLA welcomed the change to the stamp duty rates for the purchase of rental homes, but said the Chancellor should go further. “The additional rates should be scrapped in cases where landlords invest in properties adding to the overall supply of housing,” he said. “This includes investing in new build and bringing empty homes back into use.”

There was also a boost in the Budget for agents, many of whom have been furloughed. Mr Sunak announced that though the furlough scheme would end in October, employers will be given a £1,000 bonus per person to take furloughed staff back on, providing they were employed through to January.

INDUSTRY WELCOMES MOVE

The news has received a warm welcome from a property industry still recovering from a near total shutdown of the market during lockdown.

Tim Hyatt, head of residential at Knight Frank, said: “Moving house has a clear multiplier effect for the wider economy, different sized businesses in all areas feel the knock-on benefit.

“Today’s announcement to temporarily cut stamp duty will act as a shot in the arm for UK housing and further bolster a market which has come out of a state of suspension.

“However, in order for a fully functioning market to return, the availability of higher loan-to-value mortgages must also be improved to support first time buyers across the country.”

Patrick Littlemore, CEO at London estate agency, Marsh & Parsons, commented:“We welcome the Chancellor’s temporary stamp duty holiday on properties under £500,000 until the end of March next year. This is a chance for buyers to secure a home at a discount and for sellers to take advantage of this injection into the property market.

“We advise potential buyers and sellers that the selling and buying process can be lengthy so quick action is necessary. We are still seeing high levels of interest for London properties, be it first time buyers, people looking for a pied a terre or a home closer to outdoor space post lockdown. We experienced our busiest June we’ve had in eight years for new sales being agreed and expect transaction levels to significantly rise thanks to the Chancellor’s incentive.

Mark Hayward, chief executive of NAEA Propertymark, said: “We welcome the Chancellor’s announcement this afternoon that he will be raising the threshold at which buyers will pay stamp duty to £500,000. This a is a welcome commitment by the government and we are glad that they have listened to our calls to help sustain the property market following lockdown.

“These measures will enable people looking to buy a home to have the confidence and stability to be able to move forward with their purchase, which in turn will have a knock on effect on the wider economy as people buy white goods and furniture.”

Richard Donnell, research and insight director at Zoopla, said: “The immediate increase in the Stamp Duty threshold will help sustain the rebound in housing market activity across England. The benefits will be immediate; nine of ten transactions in England will no longer be subject to the tax and in London and the South East, home to more expensive properties, homebuyers can save up to £14,999 overnigh

“The government will expect the change to stimulate more housing sales over the second half of the year and that savings made by buyers will be reinvested in home improvements, white goods and furniture, rather than bidding up the cost of housing.”

Isobel Thomson, chief executive of safeagent, commented: “Today’s package of measures announced by the Chancellor demonstrate that we are all in this together. Schemes to create youth employment, the furlough employers incentive and boosts to tourism and hospitality are all very welcome. We know that for the private rented sector, these measures have an important knock-on effect in helping to support many tenants’ finances and their ability to pay their rent.

“Including landlords in the Green Homes grant is a positive incentive to improving energy efficiency in the PRS and ultimately keeping energy costs down for tenants.

“Despite these positive plans, some renters will continue to face financial difficulties. Here, the role of agents is key in maintaining equilibrium in the rental sector, supporting them through managing their arrears and ensuring lines of communication are kept open between tenant and landlord. Helping tenants maintain their tenancy wherever possible is the best outcome for everyone.”

Kevin Shaw, managing director of residential sales at LRG, said: “We welcome the immediate implementation of Sunak’s stamp duty holiday. The post-lockdown property market is looking stronger than initial forecasts suggested, and this initiative will continue to drive its recovery and boost the upward curve that the market now finds itself on. It will also help to alleviate any lingering fears over how the market may fare this year due to the pandemic.

“This ‘holiday’ should also go some way to help stimulate the market for younger people, which should be a real priority for the Government – it should be doing all it can to help younger generations get onto the property ladder. Not having to pay stamp duty may encourage more first-time buyers to purchase homes, especially in regions where the threshold is relatively low to the cost of housing.”

Nick Leeming, chairman of Jackson-Stops, welcomed the move but called for a wider review of stamp duty thresholds. “I am pleased to hear that the property industry’s calls for a stamp duty reform have finally been heard,” he said.

“Sunak’s stamp duty reform has come at the right time and will have an immediate impact on the volume of sales agreed in the coming weeks. With nearly one fifth of UK adults considering a home move in the next 12 months, this stamp duty holiday unlocks great potential for the market.

“There is no denying that stamp duty has previously put buyers off entering the market; 41% of our clients believe there should be a wholesale reduction in stamp duty across all price brackets. Meanwhile, over a quarter wanted the government to abolish stamp duty on all homes under £500,000.

“There should be a flurry of fresh buyers entering the market imminently, with the hope of completing their transactions before the tax break comes to an end. We hope the government considers a wider reduction across all price brackets in the near future.”

Glynis Frew, chief executive of Hunters Property, commented: “This is excellent news during a challenging time for the market and if implemented immediately as promised, should help to kick-start activity. Without doubt it will help first time buyers and we must look after them, they are vital to the market.”

Anthony Codling of property portal twindig was more cautious, however. “It will be interesting to see if the stamp duty cut leads to a thriving UK Housing market and provides the confidence in buying selling moving that we need,” he said. “I hope I am wrong, but history suggests otherwise.”

Referring to the Chancellor’s boost to the hospitality sector, he added: “We may be being encouraged to eat out to help out. but we are certainly not being encouraged to move out.”

BUY-TO-LET CONCERNS

However, there was concern the buy-to-let market did not appear to be included in the stamp duty holiday.

“The government’s stamp duty holiday is welcome news for the housing market overall, but there needs to be more clarity on what this will mean for buy-to-let landlords,” said Franz Doerr, CEO of flatfair.

“Thousands of landlords have already left the sector in recent years, and support to help increase the number of homes available for rent will be sorely needed with the numbers of renters expected to increase as incomes plummet and mortgages become harder to get thanks to the economic impact of Covid-19.

“The government needs to realise that homeownership at all costs is no longer sustainable, and should have announced more to support both renters and landlords.”

Jamie Cooke, managing director of iamsold, the UK’s largest property auctioneer, added: “This is massively positive for the property sector. The market return since the easing of lockdown has been strong, and this is a good move from the Government to help to sustain the positive sentiment.

“As for auction, this could see a strong return of buy-to-let investors who are perhaps sitting on cash reserves, although we assume the three per cent investor surcharge will remain.”